The Indian Media and Entertainment (M&E) industry is currently in a golden era of content volume and diversity, driven primarily by the rapid rise of Over-The-Top (OTT) streaming platforms. As per the FICCI-EY 2024 report, the sector expanded by 8% in 2023, reaching INR 2.3 trillion, with digital media at the forefront of this growth.

Also, India’s media and entertainment industry is going through a massive financial restructuring in terms of content financing opportunities. In the past, making a movie seemed like a gamble. Producers spent crores of rupees producing a film and hoped it would be a hit at the box office to earn their money back. But today, a new method called content financing is changing the entire process of film production.

Production houses are now raising money based on deals they have already secured with streaming giants such as Netflix and Amazon Prime Video, television rights, and music labels. This shift makes the business of making movies much safer and opens up new investment opportunities for filmmakers.

Key Highlights

- The Shift: Producers are no longer relying solely on unpredictable ticket sales. They are raising funds secured by contracts with streaming apps (OTT), TV channels, and music labels.

- The Problem Solved: Streaming services often pay producers after the show is released. Content financing firms lend producers money during the making of the show so they can pay their production bills.

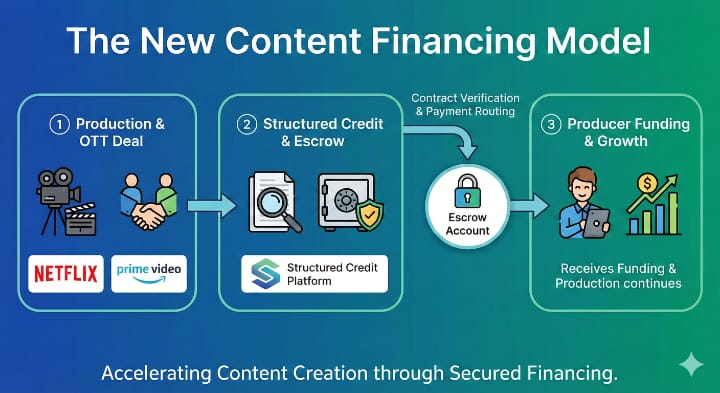

- Cheaper Loans: Traditional money lenders in the film industry charged high interest rates (up to 36%). New platforms offer safer, organized loans at 18–24%.

- Rapid Growth: Platforms such as BetterInvest have reportedly funded more than 230 projects, as claimed on their website, demonstrating that this model is effective.

What is Content Financing and How Does It Work?

To understand content financing, we first need to look at how the industry used to work. For decades, Bollywood and regional cinema relied on private financiers. They were often wealthy individuals who would lend cash at very high interest rates (sometimes 36% or more). It was risky; if the movie flopped, the money was often lost.

Today, the model is more like a standard bank loan, but tailored to film production. It solves a specific “Cash Flow” problem.

The “Financing” Problem

When OTT platforms and broadcasters sign content deals, they typically don’t pay the full amount upfront. Usually, a producer gets only 10–30% at signing, with the rest paid months later once the content is released. This can lead to cash-flow issues that delay production.

The Solution: “Discounting” the Contract

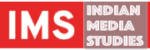

This is where new financial technology companies (such as BetterInvest, NV Capital, or the specialized verticals of NBFCs), which are structured-credit platforms, are stepping in as solutions, providing quick, cost-effective financing based on these guaranteed contracts to address this longstanding challenge. The process works like this:

- The Proof: The producer shows the financing firm their signed contract with OTT platforms, TV channels, or music labels.

- The Loan: The firm sees that the money is guaranteed (since OTT platforms like Netflix or Amazon Prime are reliable payers). They lend the producer 50–80% of the money immediately.

- The Repayment: When Netflix finally releases the payment, it goes into a special locked bank account (called an Escrow Account). The financing firm takes their loan back with interest, and the producer keeps the rest.

This method turns a creative risk (“Will people like the movie?”) into a financial certainty (“Netflix has signed a contract to pay.”).

These structured credit platforms are also available to independent content creators to support channel growth, based on their YouTube earnings and previously secured funding.

The Bigger Picture

This rise of organized content financing isn’t just business news; it affects what content we watch as an audience and the new avenues available to us as investors.

1. Better Content for Viewers

When producers have access to faster, cheaper capital, they don’t have to stress as much about “mass appeal” just to please risk-averse lenders. They can take risks on unique stories, diverse actors, and high-quality production. The next great web series we binge-watch might exist only because of this modern financing.

2. New Investment Opportunities

Previously, only industry insiders could invest in movies. Now, because these loans are backed by contracts from big companies (like Netflix, Amazon Prime, Sony, Disney+, Hotstar, or Zee), they are considered safer assets. Content financing firms like BetterInvest have registered with the Securities and Exchange Board of India (SEBI) to launch a Category II alternative investment fund. The company is also evaluating an NBFC (Non-Banking Financial Company) license to offer customized financing products. This professionalization signals that structured content financing is here to stay and that India’s financial regulators view it as a legitimate, important sector worth supervising. Platforms are beginning to allow regular investors to put money into these funds, offering a way to profit from India’s entertainment boom.

3. Long-Term Income

As Vivek Menon from NV Capital points out, a movie isn’t just a 3-hour event anymore. It makes money for 60 years through satellite rights, music rights, overseas dubbing, and streaming. This makes content financing a stable, long-term business rather than a one-time lottery ticket.

Conclusion

India’s media and entertainment sector is maturing. They are moving away from the “gambling mindset” of the box office and moving toward a corporate structure. Earlier, everyone used to say that ‘content’ is king; now the same goes for ‘contracts,’ they are king too. Structured credit platforms are democratizing content financing, turning it from a high-risk venture into a predictable investment class.

For the audience, it means more stories. For the industry, it means stability. The only question that remains is how quickly traditional studios adapt to this new way of handling finances.

This analysis is based on reports regarding BetterInvest and NV Capital originally published in ETBrandEquity.