Corporate Communication Case Study: “Big Bank” campaign of Barclays Bank

This case study on corporate communication examines the disastrous “Big Bank” campaign that Barclays Bank ran in the UK in the early 2000s. The campaign aimed to portray Barclays as a powerful and dominant financial institution. However, it backfired spectacularly, leading to public backlash and reputational damage.

Campaign Objectives

- Project an image of strength and reliability.

- Attract new customers, particularly larger businesses.

- Position Barclays as a dominant and reliable financial institution by reinforcing its position as a leader in the UK banking sector.

Campaign Strategy

- Launched a national advertising campaign with the slogan “A big world needs a big bank.”

- Highlighted Barclays’ global reach and extensive financial services.

- The focus was on size and dominance, including a significant non-profitable branch closure program.

Campaign Execution

- The “Big Bank” messaging clashed with the branch closures, which were perceived as a betrayal of local communities and a lack of commitment to personal service.

- The impersonal tone of the campaign alienated customers, who felt their needs weren’t being prioritized.

- The focus on size and global dominance came across as arrogant and insensitive to customer concerns.

Campaign Results

- Negative Public Perception: The campaign backfired, with the public perceiving it as arrogant and insensitive. Accusations of prioritizing profits over customer relationships.

- Branch Closures: Coinciding with the campaign, Barclays announced the closure of 170 branches, further fueling public anger.

- Media Backlash: Media outlets criticized the campaign’s disconnect from the needs of local communities.

- Loss of Customer Trust: Negative public perception eroded customer trust and loyalty.

Discussion

In the campaign ‘A big world needs a big bank,’ Barclays had spent £15 million, which featured celebrities such as Sir Anthony Hopkins and Tim Roth. One of the earlier ads featured Welsh-born Sir Anthony Hopkins talking from the comfort of a palatial home about the importance of chasing ‘big’ ideas and ambitions.

The advertisements had received good pre-publicity, but they turned into a communication disaster when they coincided with the news that Barclays was closing about 170 branches in the UK, many in rural areas, including the village of Sir Anthony Hopkins.

The adverts provoked a national debate in the UK when junior minister Chris Mullin said that Barclays’ customers should revolt and ‘vote with their feet’.

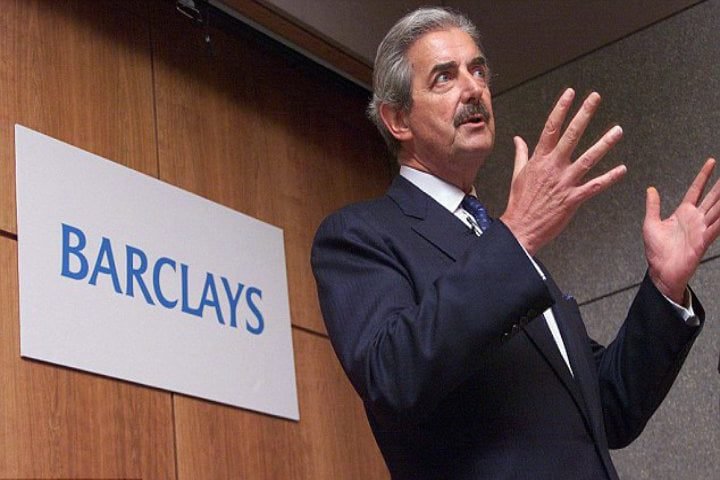

Barclays’ image crisis worsened when it was revealed that the new CEO, Matthew Barrett, had been paid £1.3 million for just three months’ work.

Barrett further made a blunder by saying that he did not borrow on credit cards because they were too expensive and that he has advised his four children not to pile up debts on their credit cards.

Matthew Barrett had explained the branch closures by saying, ‘We are an economic enterprise, not a government agency, and therefore have obligations to conduct our business in a way that provides a decent return to the owners of the business. We will continue to take value-maximizing decisions without sentimentality or excuses.’

Hopkins issued a clarification about being used as a scapegoat; he is just an actor, and he did not run Barclays Bank.

In an attempt to respond to the image crisis, Barclays extended opening hours to 84 percent of its branches and recruited an extra 2,000 staff to service the extra hours.

In 2008, at the height of the global financial crisis, many banks and financial services institutions (including the Royal Bank of Scotland) turned to the UK government for cash injections. Barclays, however, decided not to turn to the government for aid, believing that the government as a main shareholder would lead to all sorts of business decisions under the scrutiny of journalists and taxpayers.

Conclusion

The Barclays “Big Bank” campaign serves as a cautionary tale for corporate communication. Focusing solely on brand image without considering customer sentiment can have detrimental effects on the business. Building trust through transparency, customer focus, and a commitment to local communities is essential for long-term success.

It also demonstrates the importance of aligning messaging with actions, prioritizing customer focus, and developing positive community relations. By neglecting these aspects, Barclays’ “Big Bank” campaign caused significant reputational damage.